The Gist: LPT, the Chew Toy Tax

Ireland's Local Property Tax creates the illusion of political choices for our newly-elected councillors.

Newly elected local councillors have been taking their seats for the first time in recent weeks, cutting deals with other parties to share power and goldy-looking chains.

The nature of these fights is less bald men fighting over a comb and more starving men fighting over an imaginary biscuit.

One of the most notable facts about Irish local politicians is just how little power they are allowed to wield. Ireland comes nearly bottom of the European table for the effectiveness of our local democracy. On Page 7 of this assessment from the Council of Europe, they found "Irish local government turns out as being among those with the lowest scores, with a rank only just above Hungary and the Republic of Moldova."

This is mainly because Ireland's local government system effectively remains colonial in its setup. We have a collection of satraps appointed from central government who actually run things and we have hundreds of elected representatives who are, in effect, voted in as lobbyists for the electorate. Even the Council of Europe's visitors saw this historical model persisting in central government's mind and commented on it;

When the monitoring delegation visited the Custom House in Dublin, where the Department of Housing, Local Government and Heritage resides, it was informed that “local government has been administrated and supported from this house for 200 years”. The house was used by the British as the location where local government in Ireland was controlled, but after independence also by the Irish central authorities. This was a telling way of expressing how central government views local government – something that is administrated and not primarily regarded as self-governing units.

A few years back (under pressure from the Troika, who were sort of national sponsors sent in to manage us back to administrative sobriety after the financial crash saw FF take us to rock bottom) the Government came up with the wheeze of the Local Property Tax.

This scheme was designed to give the illusion of financial autonomy to Ireland’s elected local authorities while ensuring they never actually got to change anything with their decisions. Imagine it as the taxation equivalent of one of those bunches of colourful plastic keys you give to babies to chew on.

The Local Property Tax was unpopular with an electorate who were being squeezed on all fronts while also experiencing the mental anguish of being forced to learn how international bond markets worked. But in reality it was carefully designed to be hooey from the start.

Each local authority was allowed to set a discretionary extra bit of the tax. This could be up to as much as an extra 15% on the baseline. Given that the entirety of the LPT only pulled in 7% of local authority funding, the totality of the democratic fund raising powers granted to the elected councillors consisted of arguing over the fate of just 1% of their local authority’s total budget.

the taxation equivalent of one of those bunches of colourful plastic keys you give to babies to chew on.

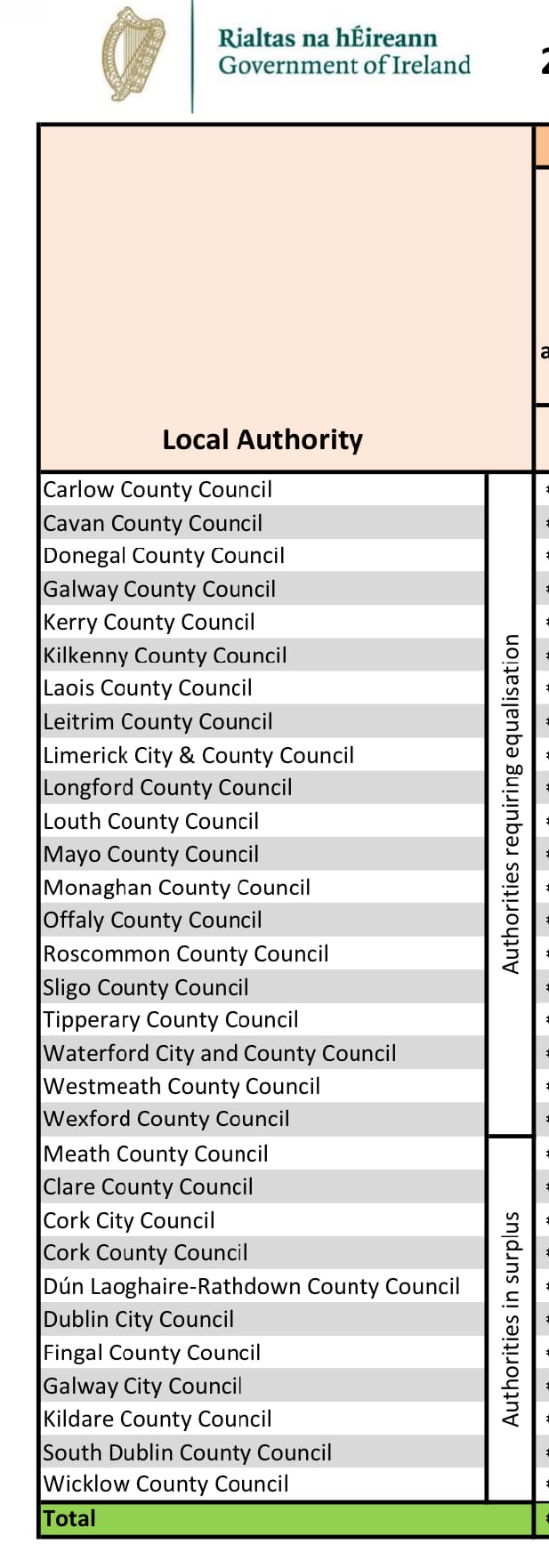

But even that amount of power was too radical for central government’s liking. So they built a second mechanism in the back of the tax. If you were in a local authority which could actually raise some extra money (mostly, because you had a city or environs to act as a valuable taxable property base) then that extra money was taken away and put in an “equalisation fund” before being given away to all the other local authorities.

In effect, the councils who could expect to raise extra money from a LPT raise were taxing their voters to subsidise services those voters would never see.

The amount that the lucky recipients of the LPT money got from their town mouse cousins was set by central government based on a set exceedingly opaque criteria. Indeed, even today, the basis for deciding who gets funded and by how much has still not been published. That formula, recently reviewed, has been vaguely described as being an undefined mix of

- population

- area

- deprivation levels

- local authority income raising capacity

- national policy priorities

And that mystery continues, even in the face of efforts by politicians to try to find out exactly how this mystery meat is made. When the Assistant Secretary General of the Department of Local Government was before the Public Accounts Committee, Catherine Murphy TD tried to get details of the secret formula out of her witness.

Ms. Fiona Quinn: It is very transparent. On the Deputy's point around population, 10% is dedicated based on population, but deprivation, to which 20% is allocated, also takes in population, so that balances the city areas out. Obviously, geographic area is the largest percentage weighting applied to it in the new model. The reason for that is the cost of delivering services over a much more geographically dispersed region.

This is the closest we have to finding out what is the "very transparent" formula for funding local services in Ireland. We know 10% of the decision is based on how many people there are, while geographic area is the largest percentage weighting applied to it.

In other words, when it comes to funding local services, it is mostly not paid for the people who live in an area, but for the square footage of land. Talk about a lingering colonial mindset.

The basis for this division is blithely asserted as being due to "the cost of delivering services over a much more geographically dispersed region". But that is patently absurd. A mostly empty tract of land, with scattered one-off houses, doesn't need the same level of services as a densely populated city. You don't need the same number of libraries for 10 people as you do for 10,000 people, no matter how far you spread the 10 out.

it is mostly not paid for the people who live in an area, but for the square footage of land.

However, as the Assistant Secretary-General of the Department refers to, there has been an update to the previous scheme. Instead of the previous 'equalisation' scheme (where the money making Local Authorities had their extra tax taken from them and given to the others) Local Authorities are now keeping 100% of the Local Property Tax.

This is presented as giving them a exciting new opportunity to raise and spend taxes in their local areas, for their own locality's benefit.

But, as we've seen, central government abhors the idea of giving any real tax-and-spend powers to local politicians. So, to make sure that nobody actually saw the benefit of their local taxes, they introduced a matching reduction in central government funding for designated spending.

Let's go back to that exchange between Catherine Murphy TD and the Department's Assistant Sec-Gen.

Ms. Catherine Murphy: What occurs now is local authorities will have a baseline and once they go above it, they then have to self-fund things like roads. Motor tax is collected, but local authorities must use what is collected via the LPT on road repairs.

Ms. Fiona Quinn: Self funding, yes.

Ms. Catherine Murphy: It is daft. This is made to be complicated for that reason. If the vast majority of people had an overview of this, there would be a bloody riot.

You can tax your population any sum you want, but they can never see the good of it. Chew away on these plastic keys, central governement says to our toothless local representatives, jingling them in front of councillors.

All of which makes statements about the centrality of Local Property Tax under this regime as the closest we have seen to politicians literally throwing their toys out of the pram.